Is Giving An Allowance For Helping With The Household Chore List

A Good Way To Teach Children And Teenagers Money Management?

You have been giving your children money for doing chores.

You have company coming over and need to get the house straightened up quickly.

You ask the children to help pick up the living room while you clean the bathroom.

The first response you hear is, “Well, how much will you pay?”

Your other child chimes in, “Yeah, that’s not included in what we do for our allowance!”

You become frustrated and annoyed because you are in no mood to negotiate right now. You just want to get the house cleaned up as quickly as possible so you’re ready for company.

You begin to wonder if giving your children money for chores is a good idea. It seems like you are constantly getting into battles over how much they will get for doing even everyday chores.

Allowances are a controversial practice for developing responsibility. Some parents view allowance as a privilege children earn, while others view it as each family member’s right. Most parents connect allowances to chores — but this often leads to problems.

Both allowances and chores each teach life skills. Allowances can teach children and teenagers money management: how to earn, save, budget, and prioritize purchases. Chores can teach cooperation and responsibility: pitching in as a member of the family, following through on agreements, and doing quality work.

Separately, each is a valuable teaching tool. When combined, however, problems often arise.

When you pay children for chores, children often do the chores only for the money, not to help as a family member. Consequently, money is the value, not cooperation. Then, if you ask the child to do an extra job or accept more responsibility, the child may ask, “How much will I get for it?” Soon, you become a labor negotiator, paying increasing amounts of money just to get basic chores done. If children don’t complete a chore and don’t care about money, the chore still doesn’t get done. (Yes, there are children who don’t care about money, especially if someone uses it to control them.)

You want your children to learn that jobs can earn money since that’s the way the real world works. There are many jobs in the real world, however, that require work without pay. (Do you get paid for washing your dishes or doing the family’s laundry? If so, I want to live in your house!)

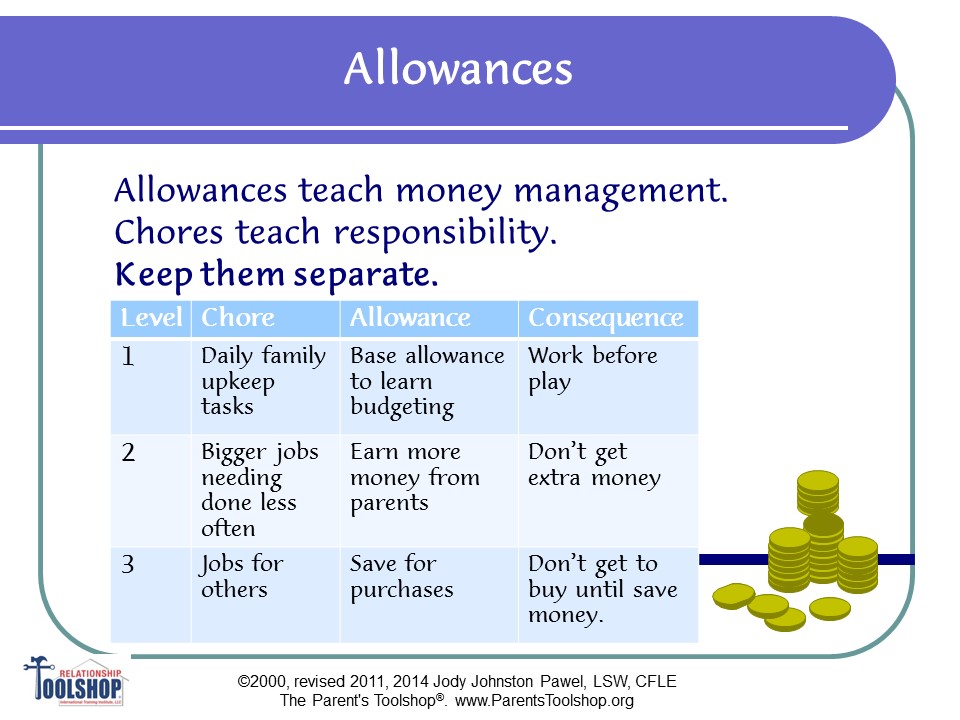

You can meet your goals for teaching responsibility, money management, and cooperation, without negative side effects, by following a three-level plan for chores and allowances. Lower levels have no connection between allowance and chores; children have responsibilities simply because they are family members. Higher levels make stronger connections, so children can also experience earning and saving extra money.

Level 1: Base allowance. Give a base allowance to teach children and teenagers money management skills. If children don’t manage their money, let them experience the consequences. Children often spend their money carelessly for a couple of months. If you don’t criticize or rescue them when they run out of money, children usually realize they must save their money for nicer purchases and naturally change their spending habits.

Have children do base chores simply because they are part of the family to make the household run more smoothly. Do not connect their base allowance with their base chores. If they do not do their basic chores, they can experience a loss of social privilege, not money. This teaches the value of work before play. Level 1 chores might include making one’s lunch, keeping one’s room neat, and a regular chore such as vacuuming or dusting. Chores such as doing the dishes or setting the dinner table can rotate among family members. The effects of not doing these chores are logical: no lunch that day, unable to have friends in the house because it’s too messy, not eating until the table is set, and no cooking until the previous meal’s dishes are clean. Include the children in coming up with this household chore list.

Level 2: Earning more money. Children can earn extra money if they accept additional responsibilities beyond self-care and basic chores. These chores are usually more difficult or need to be done less often than daily chores. Level 2 chores might include laundry, weeding, washing windows or cars, and mowing the lawn. Get an age-appropriate household chore list for children, from Shannon Rios in her book, The 7 Fatal Mistakes Divorced & Separated Parents Make. (It’s not just for divorced parents!)

Level 3: Saving for purchases. If children want to save money for a large purchase, they can do Level 3 jobs. These are large, one-time, or several-times-a-year chores such as cleaning a closet, raking leaves, or helping you with a large project like landscaping or painting. Since Level 2 and 3 chores teach children the value of earning money through increased responsibilities, consider having children do chores for relatives or neighbors. This will prevent extra money always coming out of your pocket.

The amount of an allowance depends on what children need to buy with it. Your budget may be such that you could give larger allowances, but overindulging children robs them of the experience of saving, budgeting, and prioritizing purchases.

It’s best if you involve children in deciding allowance and creating and planning the household chore list. Decide or change family-wide allowance plans in a family council. This allows children to help weigh the options, decide the details, and agree on the consequences of chores not being done. You can also negotiate allowance details with each child, using a problem-solving process.

Watch: Instagram Reel: Professionals weigh in on paying kids allowances for chores

If you would like to instill responsibility and values in your children about money management, listen to an hour-long interview I did with Alexis Neely of the Family Wealth Institute. It’s FREE!

*******************************

Jody Johnston Pawel, LSW, CFLE is President of Parent’s Toolshop® Consulting, where she oversees an international network of Toolshop® trainers. For 30+ years, Jody has trained tens of thousands of parents and family professionals worldwide through her dynamic workshops and hundreds of interviews with the media worldwide, including Parents and Working Mother magazines. She is the author of the award-winning book The Parent’s Toolshop®, and countless multimedia resources that support and educate parents from diverse backgrounds, plus other adults who live or work with children. You can find them at her award-winning website, www.ParentsToolshop.com.

Reprint Guidelines: You may publish/reprint any article from our site for non-commercial purposes in your ezine, website, blog, forum, RSS feed, or print publication, as long as it is the entire un-edited article and title and includes the article’s source credit, including the author’s bio and active links as they appear with the article. We also appreciate a quick note/e-mail telling us where you are reprinting the article. To request permission from the author to publish this article in print or for commercial purposes, please complete and send us a Permission to Reprint Form.

Source of material: Chapter 6, The Parent’s Toolshop: The Universal Blueprint for Building a Healthy Family (2000, Ambris Publishing)

My husband and I are currently taking the T.I.P.S. class. Teaching our children basic budgeting and financial skills has been a great interest of ours. After we learned about the Independence toolset and the three level allowance plan, we decided to implement it into our family. We took it a step farther because we decided to pay our sons $10 per week for their lunch money and they could decide to buy hot lunch with it or they could buy their own groceries for a lunch from home. However, we set some guidelines like they needed a fruit and a sandwich. They would get to keep the difference that they did not spend. We took them to Aldi’s and had such a great time watching them pricing different treats, fruit, and sandwich options. Our thirteen year old even discovered he could buy a brownie mix and make a pan of brownies that could be cut and frozen and eaten over two weeks, thus saving him money. My husband and I kept laughing in delight at the price comparisons and budgeting taking place before our very eyes.

Our sons are now saving and making their own purchases for their needs and wants, along with saving for college. We are excited about raising children that will be independent adults in the future and these are some important steps that will help them gain the financial experience they need.